Summary of Ferd’s financial results for 2020

Ferd’s value-adjusted equity at the end of 2021 has been provisionally calculated to be NOK 48.0 billion (NOK 41.1 billion at 31 December 2020). The return on value-adjusted equity for Ferd was 17.7% in 2021, which represents a good absolute performance for Ferd. The return expressed in NOK, after adjusting for dividend payments to the company’s owners, was NOK 7.3 billion.

As in 2020, the measures implemented by the authorities to control Covid-19 caused a significant reduction in activity in some sectors for long periods in 2021. The financial measures implemented through both fiscal and monetary policy helped to maintain economic activity and purchasing power for households and companies. In 2021 almost all the privately owned portfolio companies in the Ferd Capital portfolio reported a good improvement in operating profit compared to 2020, and the highest percentage improvements were reported by the largest companies in the portfolio. The return generated by Ferd’s portfolio of privately owned companies was very good in 2021.

The return on Ferd Capital’s combined portfolio was 21.5%. Almost all of Ferd Capital’s private companies and a number of the listed company investments saw a good increase in value in 2021. Ferd achieved a return of 21.2% on its real estate portfolio. The majority of residential and office premises saw good increases in their value, and Ferd Real Estate sold three properties in 2021 on good terms. Ferd External Managers reported an aggregate return of 11.6% (in USD terms) on its investment mandates. Ferd Invest’s portfolio of listed Nordic shares delivered a return of 13.9%.

2021 was one of the most active years in the group’s history, with a number of major asset realisations and new investments. Ferd received NOK 8.1 billion from asset realisations and dividends. The largest asset realisation was the result of Ferd’s sale of part of its shareholding in Elopak in connection with the stock exchange listing of the company in June 2021. For 2021 as a whole, Ferd Real Estate sold property assets totalling NOK 1.9 billion. New investments in 2021 amounted to NOK 7.3 billion. In mid-March 2021, Ferd added a new portfolio company by acquiring the entire share capital of Norkart, which is a market leader in technology for the municipality sector, mapping and real estate information. In autumn 2021 Ferd acquired a majority shareholding in the communications and consultancy company TRY. TRY is one of Norway’s leading organisations for creativity, strategy and technology. Ferd invested NOK 2 billion in equity funds in 2021, and several investments were made in Ferd Capital’s mandate for listed companies. The largest of these investments were in the Danish company Trifork and in Cloudberry Clean Energy.

At the end of 2021, Ferd’s net liquidity holdings (bank deposits and money market funds minus debt at the parent company level) totalled NOK 2.1 billion, which represented 4% of its value-adjusted equity. The value of Ferd’s listed shares, equity funds and liquid hedge fund investments was NOK 19.2 billion at 31 December 2021. In total, the value of Ferd’s liquidity holdings and liquid investments was NOK 21.4 billion at 31 December 2021 and represented 44% of value adjusted equity. Ferd also had undrawn credit facilities of NOK 6.7 billion.

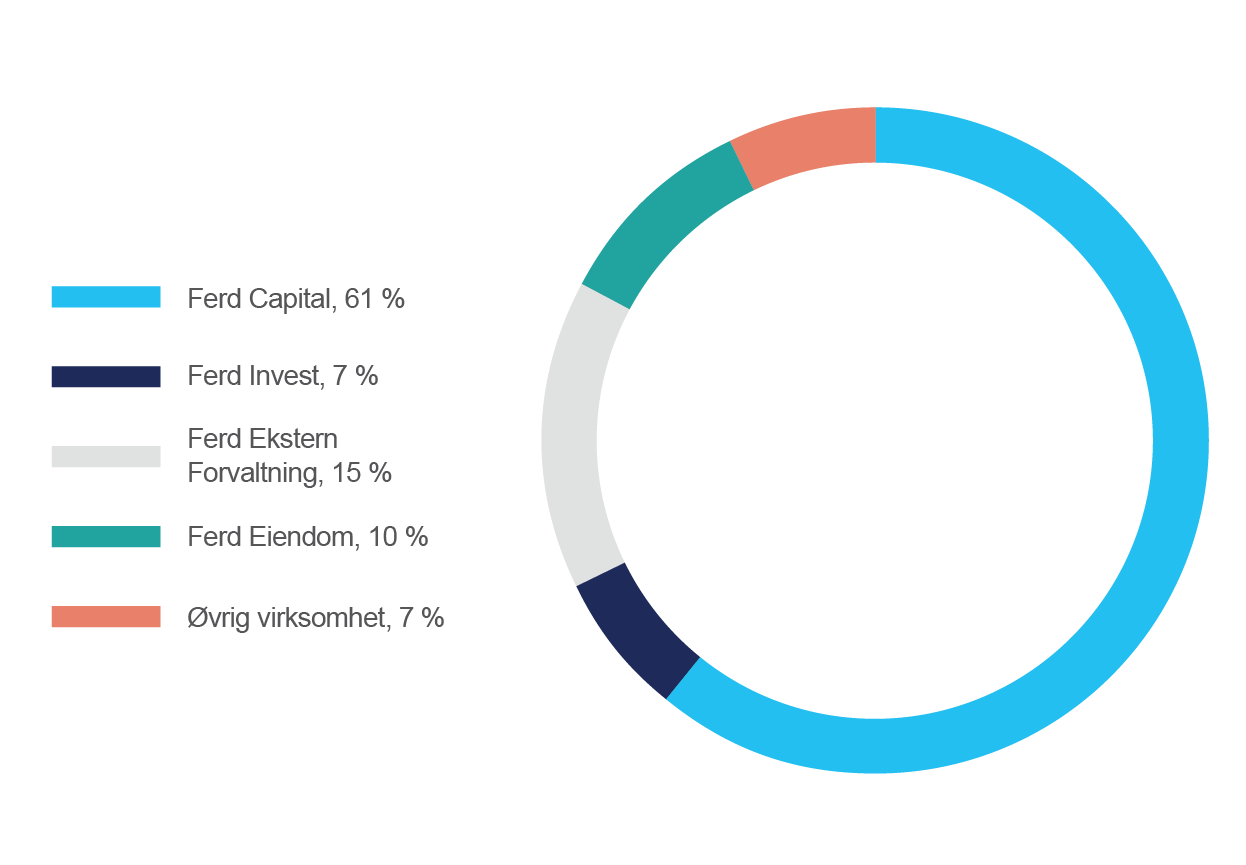

Composition of Ferd’s value-adjusted equity at 31 December 2021:

Ferd Capital

Ferd Capital is a long-term, flexible and value-adding partner for Nordic companies.

The business area has three investment mandates: Private companies, Listed companies and Special Investments. These mandates give the business area significant flexibility in terms of the types of investments it can make. Ferd Capital’s privately owned companies at 31 December 2021 were Aibel, Interwell, Mestergruppen, Brav, Fjord Line, Mnemonic, Norkart, Fürst, Servi, Simployer, Broodstock and TRY. Its largest investments in listed companies were Elopak, Benchmark Holdings, Nilfisk and Boozt.

The combined return on Ferd Capital’s three mandates was 21.5% in 2021. Almost all of the private portfolio companies achieved a good increase in their operating profit in 2021. The companies that made the biggest contribution to the increase in the value of the portfolio were Mestergruppen and Interwell. The highest returns on the investments in listed companies came from Nilfisk, Trifork and Sbanken. The combined value of Ferd Capital’s three portfolios at 31 December 2021 was NOK 29.4 billion.

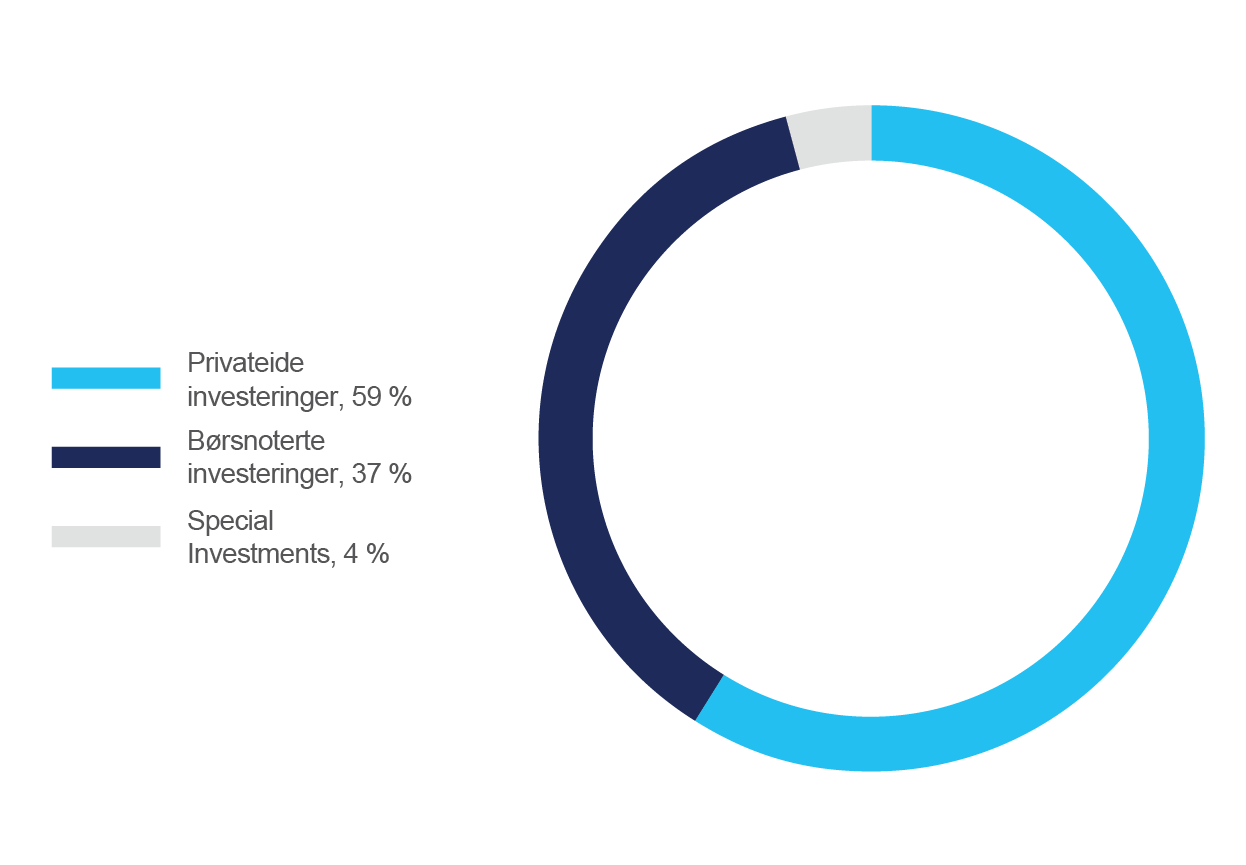

Allocation of Ferd Capital’s investments between the three mandates at 31 December 2021:

Ferd Real Estate

Ferd Real Estate is a leading urban developer. Ferd Real Estate creates value that is more than just a financial return through its active development, implementation and management of environmentally friendly real estate projects.

The real estate portfolio generated a return of 21.2% in 2021. Residential real estate prices rose by 2.2% in Oslo in 2021, which was less than the increase seen in the rest of Norway, while the yield on commercial real estate in central Oslo (CBD) was little changed. Ferd Real Estate achieved a good return as well as sound progress on several of its residential projects and many of its logistics investments. One of the portfolio’s logistics properties, situated at Langhus on the outskirts of Oslo, was sold after achieving a thorough increase in value. Ferd Real Estate sold a residential site at Ensjø to NRK, and also sold Asker Tek, an office property in Asker, with both these disposals generating a good return. The first residential development project carried out solely by Ferd in recent times, ‘Humlehagen’, saw the start of construction and the launch of the sales campaign. This project is the final part of the Tiedemannsbyen development and comprises 142 residential units. At the close of 2021, 72 of the 142 units at Humlehagen had been sold.

At the end of 2021, the value of Ferd Real Estate’s portfolio was NOK 13.0 billion and the equity value of the portfolio was NOK 4.8 billion.

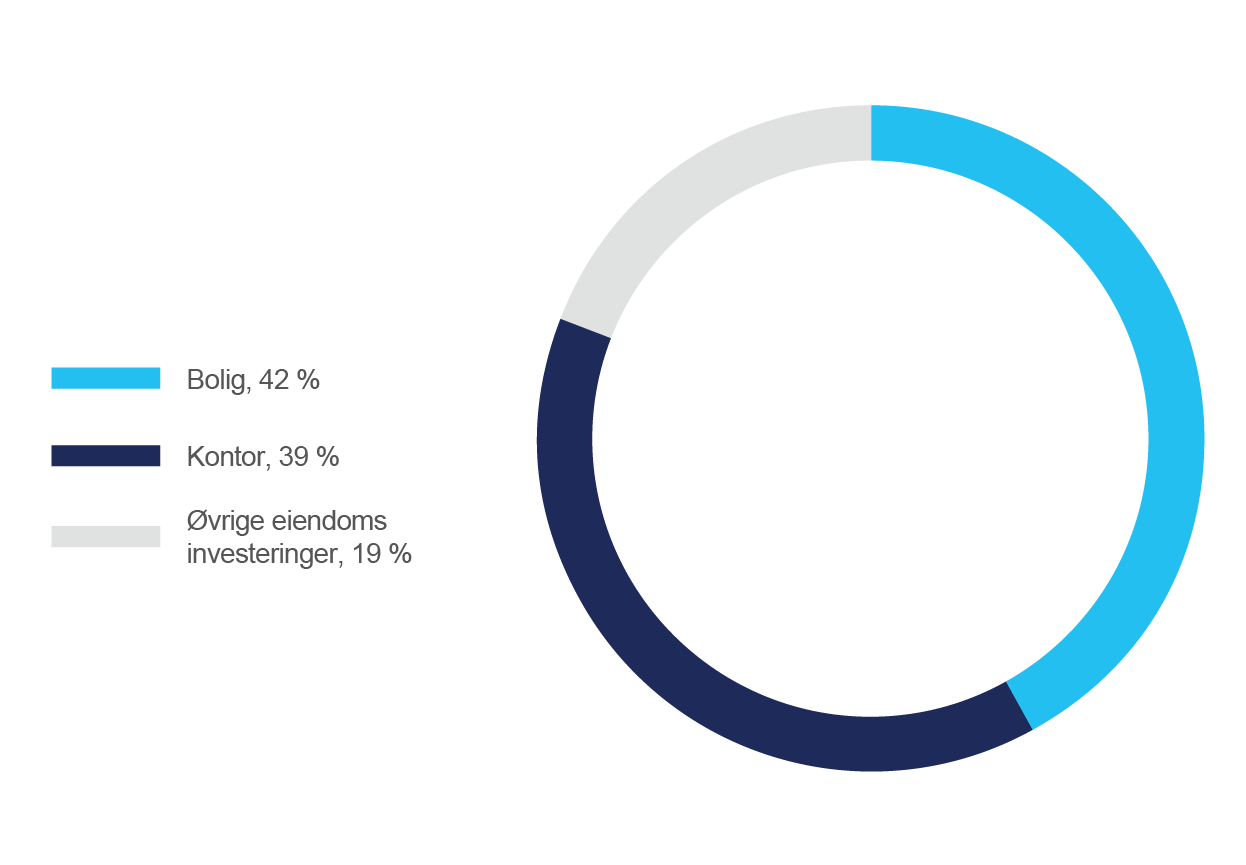

Allocation of Ferd Real Estate’s portfolio by market segment at 31 December 2021:

Ferd External Managers

Ferd External Managers is responsible for the group’s investments with external managers. The business area focuses on markets that complement the areas where Ferd invests directly, and it invests in funds that will give attractive returns over time.

Ferd External Managers’ portfolios, which are accounted for and managed in US dollars, produced an aggregate return of 11.6% in 2021. The Global Equity mandate, which is made up solely of equity funds, reported an increase of 9.7%. This performance was slightly better than the benchmark index for this mandate. The allocation to Asian equity markets, which accounted for over 40% of the mandate’s total value in 2021, reduced the absolute return for this mandate in 2021. The Global Fund Opportunity portfolio increased by 14.2% in 2021. This mandate’s largest investment again produced a very good performance in 2021, in line with 2020.

An additional NOK 2 billion was allocated to the Global Equity mandate in June 2021. The market value of Ferd External Managers’ combined portfolio at 31 December 2021 was NOK 7.3 billion.

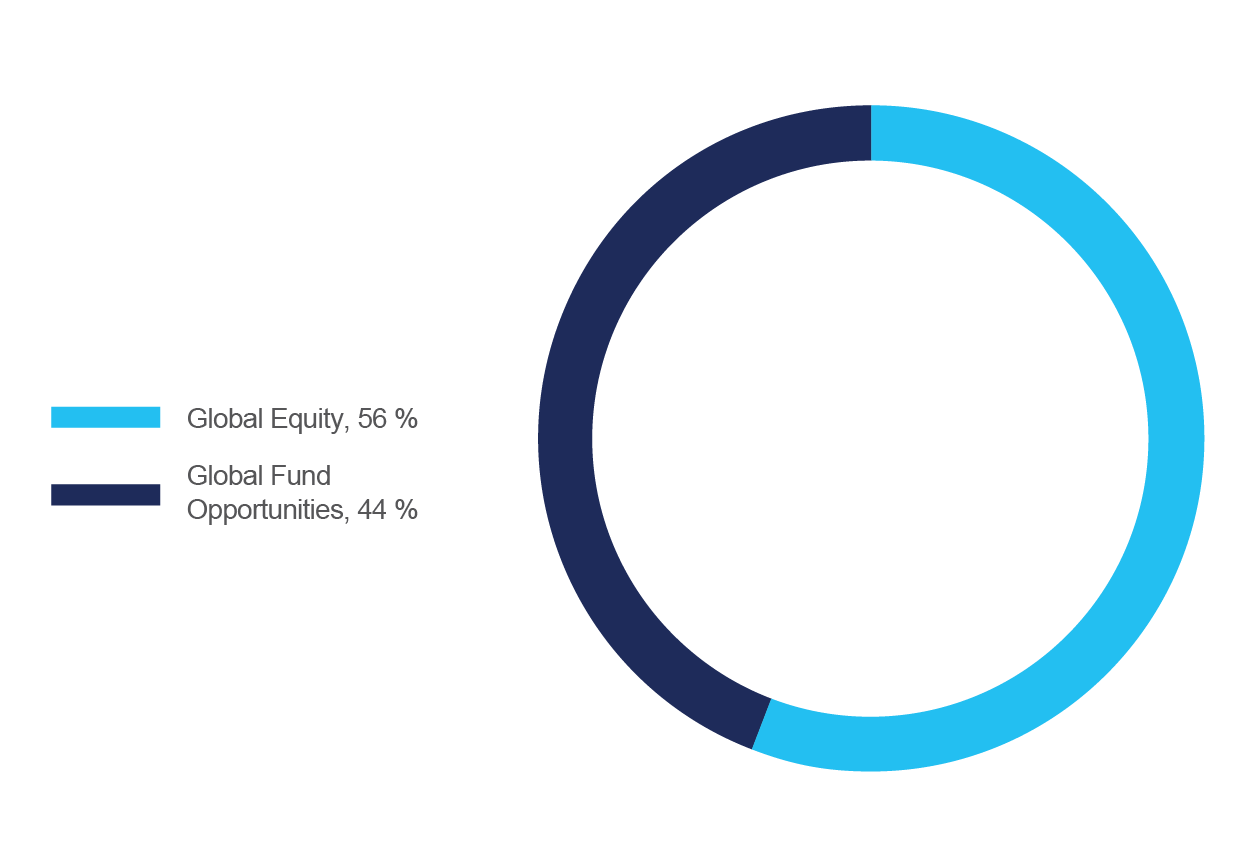

Allocation of the Ferd External Managers portfolio between investment mandates at 31 December 2021:

Ferd Invest

Ferd Invest invests in established, listed Nordic companies with strong market positions and good prospects. It holds a portfolio of investments in up to 25 companies, the majority of which have a market capitalisation of over NOK 15 billion. Its target is to generate a return that is higher than the return on a Nordic benchmark index.

The Nordic region’s stock markets achieved very good growth in 2021. Ferd Invest reported a return of 13.9% in 2021, which was less than the performance of the benchmark index which this portfolio is measured against.

The largest investments in the portfolio at 31 December 2021 were Novo-Nordisk, Hexagon, Sampo, Lerøy Seafood and Swedbank. The value of Ferd Invest’s portfolio at 31 December 2021 was NOK 3.5 billion.

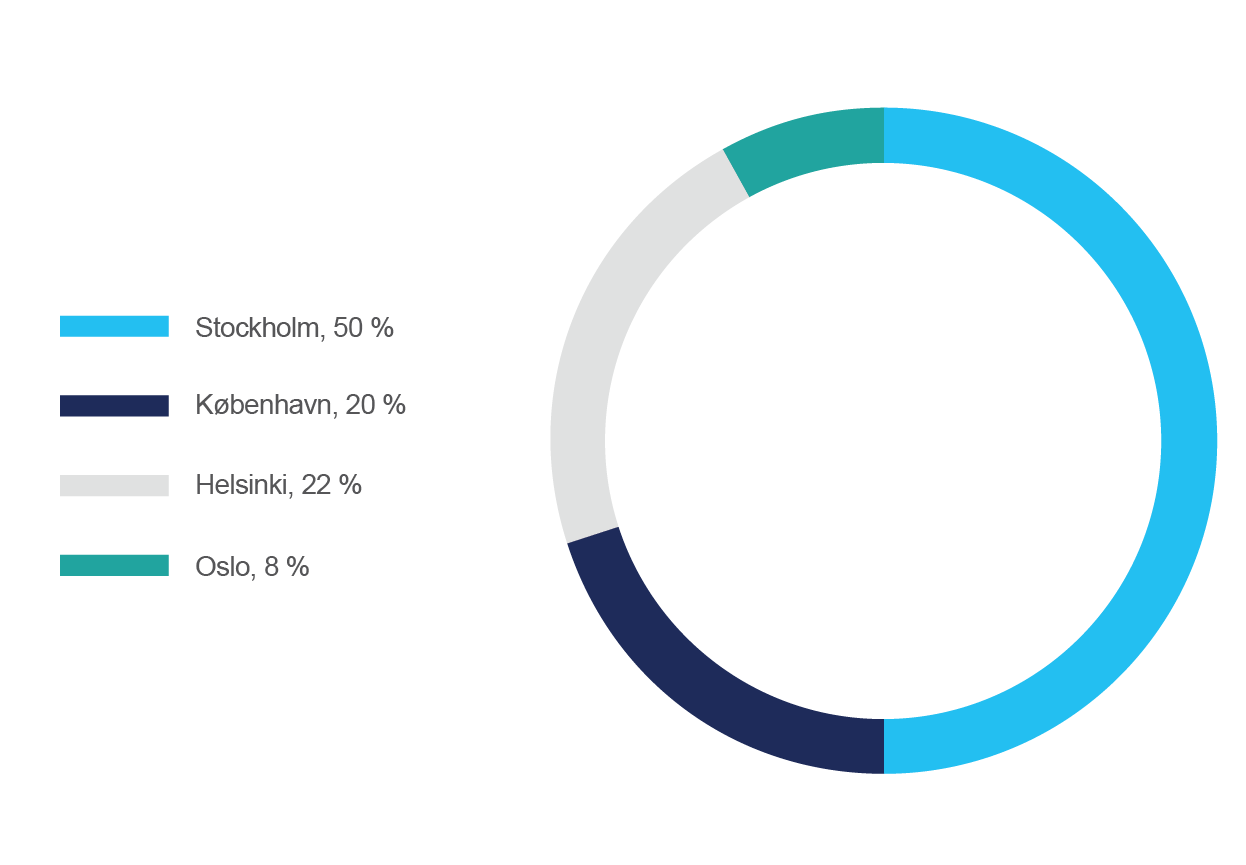

Allocation of the Ferd Invest portfolio between the Nordic stock exchanges at 31 December 2021:

Ferd Impact Investing

Ferd Impact Investing invests in early-phase companies with the potential both to have a positive impact in terms of the UN’s Sustainable Development Goals and to generate a robust risk-adjusted return. Ferd Impact primarily invests through funds, but also makes some direct investments in individual companies. It concentrates on three sectors, namely renewable energy, real estate technology and aquaculture.

Ferd Impact Investing was established in 2019 and has so far made nine investments. The business area has invested in two new fund structures, including in the venture capital fund 2150, which invests in companies which are involved in sustainable urban technology. Working in conjunction with Arendals Fossekompani, Ferd Impact Investing has established a company known as Seagust. Seagust’s objective is to develop Norwegian offshore wind power areas. As at 31 December 2021, Ferd Impact Investing had invested NOK 210 million and committed a further NOK 230 million.

Ferd Social Entrepreneurs

Ferd Social Entrepreneurs (FSE) invests in social entrepreneurs that deliver good social and financial results, and it improves their chances of success through a combination of capital, expertise and networking. FSE also collaborates with the public sector to create the tools and frameworks it needs to collaborate with these innovative entrepreneurs.

At the end of 2021, FSE’s portfolio included 13 social entrepreneurs (11 companies and two fund investments).

FSE made one new fund investment in 2021, which was in a venture fund that exclusively invests in autism-related businesses (Autism Impact Fund). This fund is the first of its type anywhere in the world, and will invest primarily in the USA and Europe. FSE also added some new portfolio companies in 2021: Lifetools AS, which has developed a communications platform for people with significant functional impairment, and Mindmore AB, which delivers digital tools for cognition testing. Mindmore is FSE’s first investment in Sweden.

In a social impact contract, a private sector investor finances a measure that has a predetermined objective, and the investment is repaid by the public sector if this objective is achieved. The public authorities only make payment if the agreed results are achieved, and investors only recover their investment if society benefits from the results of the investment. FSE financed three new social impact contracts in 2021.

Other Activities

Other Activities principally comprises bank deposits and money market funds, as well as investments in fund units purchased in the secondary market and investments in externally managed private equity funds. Ferd received just over NOK 400 million from these two portfolios over the course of 2021.

The Norwegian krone strengthened against EUR and SEK in 2021, but was weaker against USD. If translation differences caused by changes in exchange rates are excluded, Ferd’s combined return in 2021 would have been approximately 0.3 percentage points higher.